Real Estate’s Media Monopoly Is Taking Shape — VHT Was Just the Beginning

VHT Studios — long regarded as one of the most trusted providers of real estate photography and visual marketing — will officially cease operations on August 31, 2025. For many brokerages, MLSs, and agents, this is more than the loss of a vendor. It’s a clear sign that the real estate media ecosystem is undergoing rapid and strategic consolidation.

But VHT’s closure is not an isolated event. It reflects a sweeping trend in PropTech: major platforms are acquiring service providers in a bid to own the content, the data, and the distribution.

Matterport, VHT, and the Strategic Shutdown

VHT was acquired by Matterport in 2021, bringing together a respected professional photography network with Matterport’s dominant position in 3D spatial data. Now, with VHT shutting down, questions arise:

- Was this a redundancy play, phasing out overlapping service lines with Matterport’s own scan teams?

- Or was it a restructuring move anticipating deeper alignment with players like CoStar, which is rapidly scaling its media services across Homes.com and Apartments.com?

Whether it’s consolidation or reallocation, the message is clear: platform ecosystems are absorbing and streamlining visual content creation in-house.

A Broader Trend: Platforms Are Buying the Service Layer

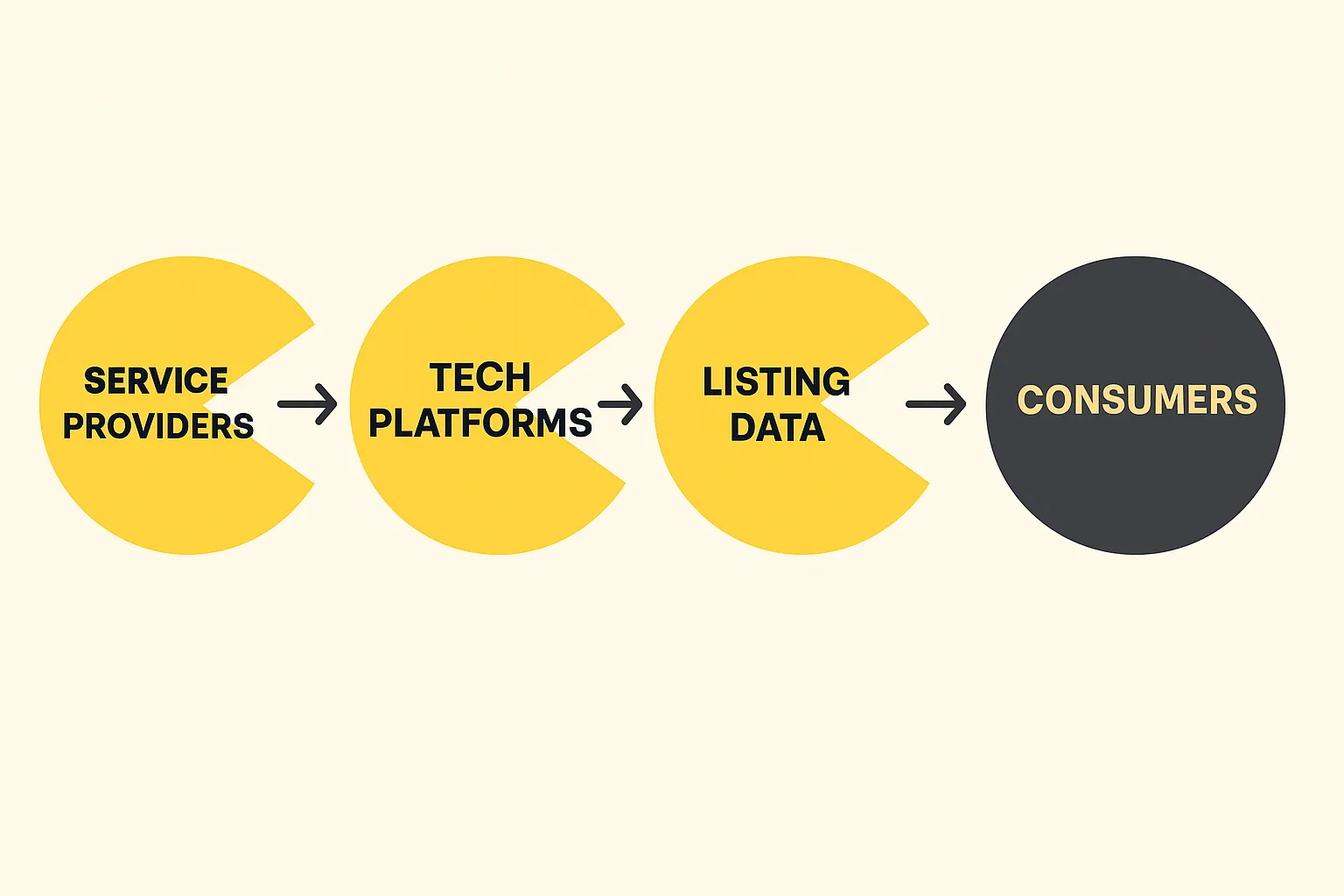

VHT’s closure echoes a bigger wave of acquisitions where PropTech giants absorb visual media providers to create end-to-end, platform-controlled service stacks.

- In 2022, Zillow Group acquired VRX Media to build a national photography network under its ShowingTime+ brand — consolidating media, scheduling, and customer engagement.

- In 2025, Yardi acquired LCP Media (formerly LCP360) to enhance visual marketing capabilities across multifamily and commercial portfolios.

These moves point to a deliberate strategy: control more of the listing experience, from media creation to lead generation — not just the data.

What This Means for MLSs and Brokerages

For MLSs, brokerages, and independent vendors, these changes present significant challenges:

- Vendor diversity is shrinking, reducing choice for agents and compliance-aligned partners for MLSs.

- Data rights and media ownership are murky, especially as platforms generate or host the content themselves.

- The traditional ecosystem is eroding, replaced by vertically integrated pipelines that combine listing, media, and audience engagement in one closed loop.

In this world, platform-first workflows are becoming the default — and agent-first autonomy may be the cost.

Strategic Questions the Industry Should Be Asking

- Will this new media monopoly improve efficiency, or limit transparency and competition?

- How should brokerages and MLSs respond to ensure data and media rights remain with the listing creators?

- Are agents being served — or just being monetized?

Final Takeaway

The closure of VHT Studios may seem operational on the surface, but it’s a clear indicator of the next chapter in PropTech — one where the platforms that own the content pipelines will increasingly set the rules.

From VHT to VRX to LCP Media, the message is the same:

Control the media, control the market.

Need help navigating this shifting landscape?

Let’s connect: https://calendly.com/proptech